|

PMI reading points to further sign of rebound, buoying up stock market

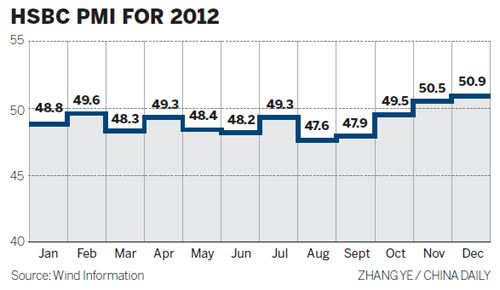

China's manufacturing activity hit a 14-month high in December, a further sign of a rebound in the country as domestic demand improves despite external weakness, HSBC said on Friday.

The preliminary purchasing managers' index released by British banking giant HSBC Holdings PLC stood at 50.9 in December. The reading is 0.4 points higher than that of November and is the highest for 2012. A reading above 50 means economic expansion.

HSBC's PMI is widely considered by China watchers as one of the most important economic indicators, sometimes even believed to be more accurate than the official PMI compiled by the National Bureau of Statistics.

The data published on Friday is a flash, or a preliminary forecast, compiled based on questionnaires completed by purchasing managers from Dec 5 to 12. Final data for December will be published at the end of the month, which typically falls in a close range with flashes.

The index "shows that economic recovery is gaining momentum supported by improving domestic demand", Qu Hongbin, HSBC's chief economist for China, said in a statement.

The sub-index for new orders stood at a 20-month high of 52.7, reflecting strong domestic demand. The employment sub-index went above 50 for the first time in 10 months. The output sub-index dipped slightly but stayed in expansion territory.

"This is a bit above consensus ... and sustains an upward trend in mood," Dariusz Kowalczyk, a senior economist and strategist with Credit Agricole CIB, wrote in a research note.

"Clearly, growth momentum is improving, but remains modest by historical standards."

The PMI data is consistent with his expectation that GDP growth will accelerate in the fourth quarter to 2.4 percent quarter-on-quarter, and 7.9 percent year-on-year, putting the annual growth rate at 7.7 percent.

|

Residential building collapses in E China's Ningbo

Residential building collapses in E China's Ningbo

![]()