Supply chain delays, inflation surge across UK may lead to "tough" Christmas

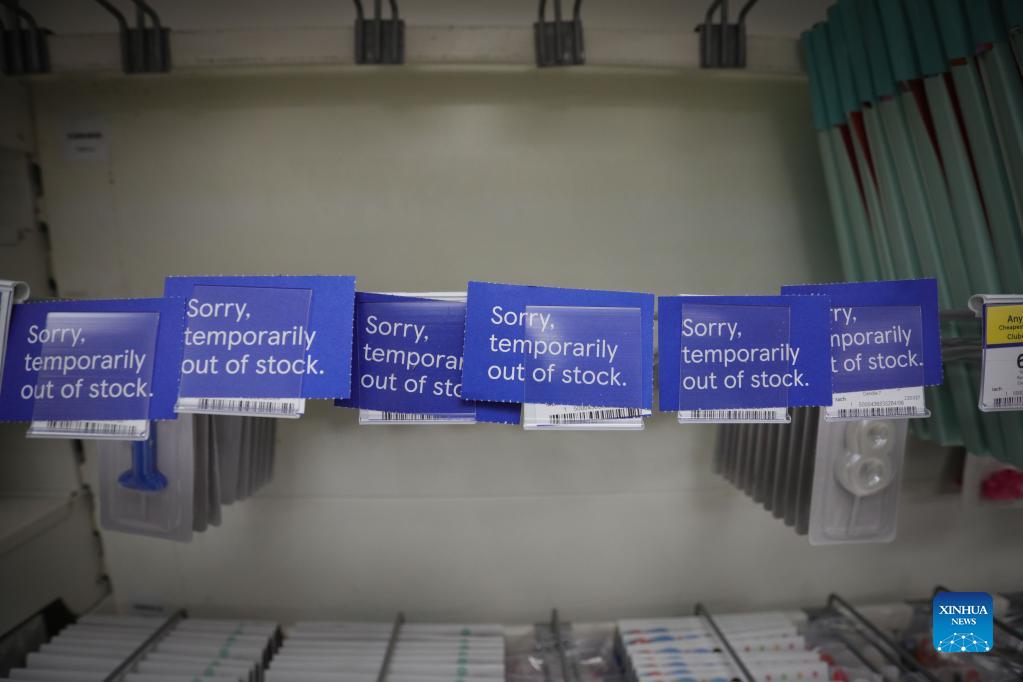

Photo taken on Nov. 24, 2021 shows signs of products out of stock at a store in London, Britain. Consumers across Britain are expected to face higher prices and fewer choices for goods this Christmas season due to supply chain delays and soaring inflation. (Photo by Tim Ireland/Xinhua)

LONDON, Nov. 29 (Xinhua) -- Consumers across Britain are expected to face higher prices and fewer choices for goods this Christmas season due to supply chain delays and soaring inflation.

The Wine and Spirit Trade Association recently urged the government to take "urgent action" over the shortage of heavy goods vehicle drivers and freight disruptions to avoid a lack of alcohol supplies in the run-up to Christmas.

The association has received multiple reports from its membership who complained that importing products are "now taking up to five times longer than they were a year ago," according to a statement issued by the body on Nov. 24.

"Businesses who had previously been able to fulfil orders in two to three days are now experiencing shipments taking 15 days to process," revealed the statement, as "drivers and vehicles are increasingly unpredictable in their arrival times, meaning goods are either not ready or are left waiting for collection."

Toys are one of the most affected categories during the festive season, along with bicycles and large homeware items, according to a recent report by the Financial Times.

Gary Grant, founder and executive chair of The Entertainer, a British toy retailer, which operates more than 170 toy shops across the country, said his company was about 10 percent behind where it would normally be in terms of the number of containers received, according to the report.

"I've never seen such conditions in over 40 years of selling toys," said Grant, quoted by the report, citing that "commodity inflation, high shipping costs, problems sourcing containers and constrained factory capacity among the issues he was facing."

According to Helen Dickinson, chief executive of the British Retail Consortium, while retailers are putting in a gargantuan effort to ensure that essential food and gifts are ready for Christmas, "they continue to be dogged by ongoing challenges supply chain problems."

Earlier this year, the government announced a package of measures to address the shortages of heavy goods vehicle drivers and butchers, including offering a Visa extention for foreigners occupying those positions.

According to Kitty Ussher, chief economist at the Institute of Directors, a British business group, the country is starting to see a vacancy paradox in the jobs market: record-high job adverts but still more people unemployed than before the pandemic.

Meanwhile, Britain's Consumer Prices Index soared by 4.2 percent in the 12 months to October 2021, hitting the highest pace since November 2011, the British Office for National Statistics said on Nov 17.

October's growth rate is up from 3.1 percent in September and more than double the Bank of England's 2 percent target for inflation.

Grant Fitzner, chief economist at the statistics office, told The Economic Times that surging inflation was mainly driven by increased household energy bills and higher prices in restaurants and hotels. "Costs of goods produced by factories and the price of raw materials have also risen substantially and are now at their highest rates for at least 10 years."

Analysts said the surge in inflation increased the possibility of the central bank raising interest rates in December.

Paul Dales, an economist at the Capital Economics UK, an economic research consultancy based in London, said combined with a decent labour market, the bigger-than-expected leap in consumer price inflation in October makes an interest rate hike in December even more likely.

Concerns over a new variant of COVID-19 dubbed Omicron with a "constellation" of mutations and the uncertainty surrounding vaccine efficacy towards the new variant may put more pressure on central bank monetary policy decisions.

The discovery of a new COVID variant "has rocked markets and clouded the outlook for UK monetary policy," said a report issued by Oxford Economics, a UK think tank.

"Granted, it's too soon to be certain about how serious, or otherwise, the health threat posed by the so-called B.1.1.529 variant is," the report said. "But the history of new COVID strains offers no reason for complacency. And it has thrown a spanner into the MPC's (Monetary Policy Committee) December policy decision."

Earlier this month, the Bank of England announced it would keep interest rates unchanged at 0.1 percent despite widespread speculation that it will raise rates to contain inflation.

The Bank made two emergency base rate cuts from 0.75 percent to 0.1 percent to support businesses and households since the start of the pandemic.

|

Photos

Related Stories

- U.S. decoupling policy, anti-globalization lead to inflation in America: report

- 77 pct Americans believe inflation affects daily life: U.S. newspaper

- Two cases of Omicron variant detected in UK as restrictions tightened

- British reckless remarks on Hong Kong affairs nothing but nonsense: Commissioner's office of Chinese foreign ministry

- UK coronavirus cases top 10 mln amid concerns over new variant

Copyright © 2021 People's Daily Online. All Rights Reserved.