— Continuing to improve the standard of living

More than 10 million urban jobs will be created, and the registered urban unemployment rate will be kept within 4.5%. Personal income will increase in step with economic development, and the rural population living in poverty will be cut by at least 10 million. The social security system will be improved, the coverage of old-age, medical, and other social security services will continue to expand, and the level of social security benefits will increase gradually. We will strive to make continued progress in making access to education, healthcare, cultural services, and other basic public services more equitable. The natural population growth rate will be kept under 6.5‰.

— Keeping the equilibrium in the balance of payments

Total imports and exports will increase by around 6%, general trade and trade in services will account for more of foreign trade, foreign investment utilized will remain stable overall, and outward foreign direct investment will continue to grow rapidly.

To achieve these targets and make our economic work for 2015 a success, we must ensure that the macro policies are stable, micro policies are flexible, and social policies meet people’s basic needs. We must make coordinated efforts to ensure steady growth, advance reform, make structural adjustments, improve the standard of living, and guard against risks. We must also continue to make innovations in and improve the way we exercise regulation at the macro level, ensure the continuity and stability of policies, and make sure that macro policies are further coordinated and work together to create synergy.

We will increase the vigor and effectiveness of our proactive fiscal policies. The government budget deficit for 2015 is projected to be 1.62 trillion yuan, which is an increase of 270 billion yuan compared to last year, resulting in a deficit to GDP ratio of around 2.3%. Of this amount, the central government deficit is 1.12 trillion yuan, and the remaining 500 billion yuan is from local government deficit. In addition, we will allow local governments to issue an appropriate amount of special bonds. Our fiscal policies will be focused on the following areas:

First, we will continue to make structural tax reductions and cut fees across the board. We will extend the trials of replacing business tax with VAT to the construction, real estate, financial, and consumer service industries. We will also make sure that the tax reduction and exemption policies for small and micro enterprises are well implemented.

Second, we will improve the structure of expenditures. This will be done by giving high priority to agriculture, rural areas, and farmers; people’s wellbeing; environmental protection; old revolutionary base areas, ethnic minority areas, border areas, and poor areas; and key eco-functional zones, and by increasing support for financing guarantee for agriculture, rural areas, farmers, and small and micro businesses. We will continue to be economical and strictly control regular expenditures.

Third, we will utilize government funds more efficiently. We will make innovations in the way we use government funds, increase the intensity of treasury cash management, and put treasury funds on hand to good use.

|  |

Day|Week

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts Graduation photos of students from Zhongnan University

Graduation photos of students from Zhongnan University A school with only one teacher in deep mountains

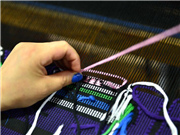

A school with only one teacher in deep mountains Glimpse of cultural heritage "Xilankapu"

Glimpse of cultural heritage "Xilankapu" Homemade cured hams in SW China

Homemade cured hams in SW China Breathtaking buildings of W. Sichuan Plateau

Breathtaking buildings of W. Sichuan Plateau Graduation photos of "legal beauties"

Graduation photos of "legal beauties" Top 10 most expensive restaurants in Beijing in 2015

Top 10 most expensive restaurants in Beijing in 2015