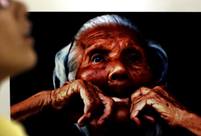

Chinese companies see depressed iron ore prices, fueled by low steel demand, as a great time to acquire assets. [Photo/China Daily]

Chinese companies look to expand their global presence as metal ore prices continue to drop

Chinese companies should be looking to increase their overseas investments in the global mining industry.

Sluggish demand in the sector has left foreign firms struggling to cope with falling commodity prices after a brief boom last year and in 2011.

A sharp decline in steel production worldwide has hit the iron ore market. In June, the World Steel Association reported that production had dropped for a fifth consecutive month.

Iron ore is the key ingredient in making steel-the backbone for industries ranging from construction to car manufacturing. But this slowdown has produced unexpected opportunities.

"The market value of these mining companies with good quality assets is declining as prices in commodities, such as iron ore, copper and even gold, fall," Wang Jiahua, vice-chairman of the China Mining Association, said.

"This is a good time for Chinese companies to look overseas for acquisitions or mergers."

The global mining industry has suffered a turbulent time since the 2008 financial crisis, which triggered a sharp drop in raw material prices. This allowed Chinese companies to expand internationally and increase the country's supply of key resources.

By 2011, they had invested, or bought, 284 foreign firms based in countries ranging from Australia to Guinea, according to figures released by the China Mining Association.

"During this period, an increasing number of Chinese companies moved in to buy overseas assets at relatively low costs," Wang said.

But in 2013, the number of overseas investments started to dry up as foreign mining firms cut operational costs to cope with the sector's changing financial landscape.

Then last year, iron ore prices plunged by 33 percent to $89 a ton after briefly rallying to $134 a ton at the beginning of 2014.

The downward spiral has continued. In April, iron ore prices dipped to about $46 a metric ton, a drop of 75 percent compared to the dizzy heights of $190 in 2011. Last month, the price recovered slightly to $60 a metric ton.

"It will take three to five years for the global mining industry to pick up," Wang said. "During that period, some foreign firms in the sector will face major challenges."

|

Top 10 summer resorts across China

Top 10 summer resorts across China Campus belle in HK goes viral online

Campus belle in HK goes viral online Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Top 10 most competitive Chinese cities in Belt and Road Initiative

Top 10 most competitive Chinese cities in Belt and Road Initiative Top 10 travel destinations in the world

Top 10 travel destinations in the world Promote reform as stock market stabilizes

Promote reform as stock market stabilizes Taking stock: the ups and downs of Chinese shareholders

Taking stock: the ups and downs of Chinese shareholders Small rise in CPI shows growth still slack: experts

Small rise in CPI shows growth still slack: experts Donations struggle to grow after China stops getting organs from executed prisoners

Donations struggle to grow after China stops getting organs from executed prisonersDay|Week