'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each other Teaming up against polluters

Teaming up against polluters

|

| The freefall of gold price stirs Chinese consumers' spending spree on gold in 2013. (File Photo) |

The bargain-hunting middle-aged Chinese women known as “dama”, have exerted the influence of the rising Chinese middle class in the gold market this year. As 2013 ends as a bleak year for gold, how do their gold investments look now?

Zhang Fengping, who along with her two sisters spent 100,000 yuan (about 16,500 U.S. dollars) on gold in May, says she is holding back to see what happens next.

“Gold prices plunged last week, encouraging me to buy another 100,000 yuan worth. But a relative who works in a bank suggested that I wait, because the price may continue to fall.”

An analyst from Société Générale is much more explicit: gold is losing ground as a safe-haven asset.

Throughout 2013, the global gold market has risen and fallen in line with expectations that the Federal Reserve would withdraw its quantitative easing (QE) stimulus. Gold has fallen 29 percent in 2013, and is heading for the biggest annual loss in 32 years.

Gold prices took off from 800 U.S. dollars an ounce after the Fed started the first round of QE, known as QE1, in 2008, and then QE2 propped up the price to an all-time high of 1,920 U.S. dollars an ounce in September of 2011. Worries about inflation in the U.S. continued to impel investor demand for gold. Although the price fell to around 1,600 U.S. dollars, two months later it was soon pushed up to 1,800 U.S. dollars by QE3.

Gold lost 200 U.S. dollars an ounce in two trading days in April this year, a result of the recovering U.S. economy and growing calls for scaling back QE.

“The big fall in metal prices in 2013 is due to the prospect that the U.S. may tighten its monetary policy, and especially when Bernanke said in May that the slowdown in QE may come soon, dragging gold down to 1,200 U.S. dollars an ounce,” says Sun Yonggang, an analyzer from Everbright Futures.

Gold traded on COMEX fell back again to 1, 200 U.S. dollars an ounce after the Fed said last week it would begin to taper its 85 billion U.S. dollars in monthly bond purchases next month.

However, Chinese consumers are not deterred by the falling prices that have continued throughout this year. In the view of Liu Guangzhong, director responsible for the Far East area of the World Gold Council, Chinese consumer persistence is due to a traditional preference for gold as an investment.

“I admit that gold has been a bad investment choice this year. But I buy gold for my child, even for my grandchild, not for speculation. So I won’t be affected too much by the rises and falls of the market,” says Zhang Fengping.

Although Chinese gold consumers won’t stop buying, they have to think about when it is the right time to take action. Market watchers believe they may wait for a long while.

“The U.S. economy will continue a steady recovery that will draw more investors away from gold assets. If gold goes below 1,100 U.S. dollars, in other words, the average gold production cost, it will be a good time to increase holdings. This will likely happen in June or July next year,” predicted Li Ning, analyst from Shanghai Cifco Futures.

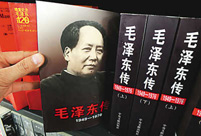

Commemorate 120th birth anniversary of Mao Zedong

Commemorate 120th birth anniversary of Mao Zedong Female soldiers of PLA Marine Corps in training

Female soldiers of PLA Marine Corps in training Chinese cities to have a very grey Christmas as smog persists

Chinese cities to have a very grey Christmas as smog persists China and U.S. - the national image in each other’s eyes

China and U.S. - the national image in each other’s eyes The Liaoning's combat capability tested in sea trial

The Liaoning's combat capability tested in sea trial Chinese pole dancing team show their moves in snow

Chinese pole dancing team show their moves in snow Rime scenery in Mount Huangshan

Rime scenery in Mount Huangshan Ronnie O'Sullivan: My children mean the world to me

Ronnie O'Sullivan: My children mean the world to me Shopping in Hong Kong: a different picture

Shopping in Hong Kong: a different picture The buzzwords in 2013

The buzzwords in 2013 Top 10 domestic news of 2013

Top 10 domestic news of 2013 Red crabs begin annual migrations in Australia

Red crabs begin annual migrations in Australia Artifacts retrieved from West Zhou Dynasty

Artifacts retrieved from West Zhou Dynasty Aftermath of Volgograd railway station blast

Aftermath of Volgograd railway station blast Fleet hits targets in training

Fleet hits targets in trainingDay|Week|Month