'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each other Teaming up against polluters

Teaming up against polluters

Shale gas assets acquired in the United States are unlikely to provide quick and substantial returns to China Shenhua, but in the long-term they will benefit Shenhua and the wider Chinese energy industry, in terms of the opportunities to acquire shale gas extraction technology and generate earnings, say analysts.

China Shenhua, the largest coal supplier and vendor in China, announced on Monday that it plans to invest 90 billion U.S. dollars in a US shale gas project with Energy Corporation of America. Shenhua said that the project could yield an estimated 3.8 billion cubic meters of shale gas in the first 30 years, amounting to around two thirds of the planned target for shale gas development set by China’s 12th Five-Year-Plan (2011-2015).

Shenhua’s acquisition is not the first time a Chinese company has become involved in shale gas in the U.S. In early 2012 China Petrochemical Corp., or Sinopec, reached a deal worth 2.2 billion U.S. dollars with US explorer Devon Energy to buy some of Devon’s stake in five shale gas assets in the U.S.

In 2011 China National Offshore Oil Corporation (CNOOC) paid 570 million U.S. dollars for a one-third stake in a shale project owned by Chesapeake Energy, the second biggest natural gas producer in the U.S.

China’s small oil players also want a share in U.S. shale assets. Last October, Lanzhou Haimo Technologies, an oil well production meter supplier, announced the purchase of a 14.29 percent stake in Houston-based Carrizo Oil & Gas's Niobrara shale oil and gas assets in Colorado for 27.5 million US dollars.

The governments of China and the U.S. set the tone for business cooperation in shale by issuing a Joint Fact Sheet on Strengthening U.S.-China Economic Relations on December 5. The fact sheet states that “The United States commits to engage with China on technical, standards, and policy cooperation, to facilitate the improvement of China’s regulatory frameworks, so as to promote the sound and rapid development of China’s shale gas exploration and development.”

Analysts believe that when Chinese companies enter North America, they are getting energy as well as experience of and advanced technology in shale gas exploration.

“The U.S. story is that attracted by government subsidies, more and more companies are taking part in shale gas development. Companies have become the major players in this field and have built a pipeline network which solves the delivery problem of shale gas,” says Lin Boqiang, former principal economist (energy) of Asian Development Bank.

Although information quoted by the Wall Street Journal says that Chinese oil giants have focused on conventional resources this year, China will continue to seek shale assets in North America. Compared to combustible ice, shale gas is seen as already commercially viable and can be produced on a large scale. With China engaged in transforming its energy consumption structure, the significance of shale gas as a new source of energy is rising.

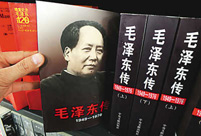

Commemorate 120th birth anniversary of Mao Zedong

Commemorate 120th birth anniversary of Mao Zedong Female soldiers of PLA Marine Corps in training

Female soldiers of PLA Marine Corps in training Chinese cities to have a very grey Christmas as smog persists

Chinese cities to have a very grey Christmas as smog persists China and U.S. - the national image in each other’s eyes

China and U.S. - the national image in each other’s eyes The Liaoning's combat capability tested in sea trial

The Liaoning's combat capability tested in sea trial Chinese pole dancing team show their moves in snow

Chinese pole dancing team show their moves in snow Rime scenery in Mount Huangshan

Rime scenery in Mount Huangshan Ronnie O'Sullivan: My children mean the world to me

Ronnie O'Sullivan: My children mean the world to me Shopping in Hong Kong: a different picture

Shopping in Hong Kong: a different picture SWAT conducts anti-terror raid drill

SWAT conducts anti-terror raid drill AK-47 inventor dies at 94

AK-47 inventor dies at 94 Mother practices Taiji with her son

Mother practices Taiji with her son  Crashed French helicopter salvaged

Crashed French helicopter salvaged Winter travels in Anhui

Winter travels in Anhui  Bird show opens to public in Calcutta, India

Bird show opens to public in Calcutta, IndiaDay|Week|Month