Death toll in Philippine ship collision climbs to 31

Death toll in Philippine ship collision climbs to 31

Guangzhou rail service suspended, 80,000 affected

Guangzhou rail service suspended, 80,000 affected

World's most famous beach cities

World's most famous beach cities

Indian-controlled Kashmir celebrates Independence Day

Indian-controlled Kashmir celebrates Independence Day

Reservoirs in S China start to release floods

Reservoirs in S China start to release floods

Actress Hsu Chi covers BAZAAR

Actress Hsu Chi covers BAZAAR

How do North Koreans stay cool in summer?

How do North Koreans stay cool in summer?

China Beijing Int'l Gifts, Premium&Houseware Exhibition opens

China Beijing Int'l Gifts, Premium&Houseware Exhibition opens

If you ever find love in Beijing

If you ever find love in Beijing

|

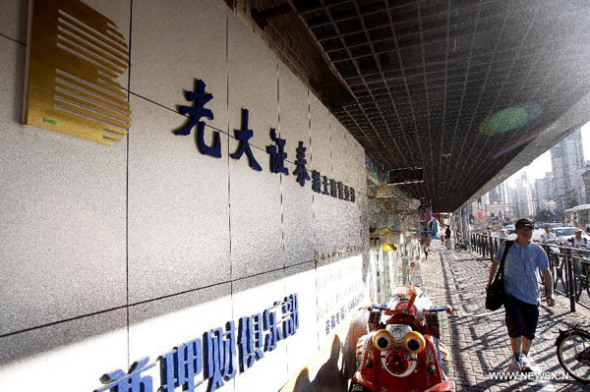

| A man walks past a brokerage house of Everbright Securities Co., Ltd., east China's Shanghai, Aug. 16, 2013. The Shanghai Stock Exchange (SSE) said Friday afternoon that the investment strategy department of Everbright Securities Co., Ltd. had encountered a problem in its arbitrage system while operating with its own funds during the morning trade at the bourse, following a dramatic spike in domestic stock indexes. (Xinhua/Ding Ting) |

"Clearly small investors buying blue chips without knowing the entire insider information became the biggest victims, while mature institutions and investors profiteer by taking advantage of the situation," she added.

Yang Guoying, a researcher with China Finance Thinktank, said the incident has "eroded investor confidence", which has already been "hit severely" by rumors about insider trading, financial fraud and price manipulation.

Media reports said Everbright Securities' "fat finger" incident touched off a 53 percent surge in trade volume on Friday morning, with tens of billion of yuan bought in as the index was pushed higher.

"Some institutions with big capital, such as Huijin (Central Huijin Investment Ltd), have been intervening in the stock market from time to time. The supervision authority lacks binding power over these activities," said Yin.

A sudden surge in the stock market is naturally linked with the "government supporting the market", leading to buying activities from small investors, he said.

Central Huijin, an investment arm of China's sovereign-wealth fund, has been constantly increasing its holdings of blue chips. It has been taken as a positive attitude from the central government that it will support the stock market, which stimulates investors, but analysts said the effects are diminished because of the prolonged poor performance of many listed State-owned companies.

On the other hand, what happened on Friday also triggered questioning into the aggressive expansion of China's financial institutions.

"As more financial institutions are using advanced technology to compete in the market, new trading methods and tools are replacing traditional ways, creating greater volatility," said Zhang Yun, a futures trader based in Shanghai.

Some analysts said many investment houses and stockbrokerages are seen to be compromising risk control in favor of speed and efficiency in making trades. The Everbright Securities case could make the authorities think twice before granting approvals to future applications for quantitative trading business and other innovations in the future.

Everbright Securities said Shanghai securities authorities had told them to suspend trading of proprietary stocks in the spot market for three months until Nov 18.

The China Financial Futures Exchange on Sunday imposed restrictions on Everbright Securities, limiting its ability to establish fresh stock index futures.

Everbright clients are complaining the mistake made by Everbright will come at their expense. Others, especially short sellers, are charging Everbright for their losses on Friday.

China Southern Asset Management and SWS MU Fund Management both corrected the valuation of Everbright Securities to 10.22 yuan per share, down from 12.12 yuan at the close of trading on Friday.

Everbright Securities shares are suspended from trading in Shanghai until Tuesday.

The China Securities Regulatory Commission said it had launched a formal investigation into the problems at Everbright Securities, which could lead to "severe punishment", depending on the results.

PLA's integrated battle group in live-fire drill

PLA's integrated battle group in live-fire drill Egypt's clashes kill 525 so far

Egypt's clashes kill 525 so far Phubbers turn social etiquette on its head

Phubbers turn social etiquette on its head Jaguar Land Rover to recall 11,852 cars

Jaguar Land Rover to recall 11,852 cars Ballet Swan Lake rehearsed in Taipei

Ballet Swan Lake rehearsed in Taipei  The five Hutong areas of Beijing

The five Hutong areas of BeijingDay|Week|Month