|

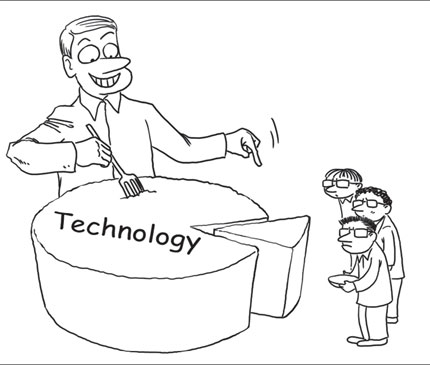

| Illustration by Zhou Tao (Shanghai Daily) |

CAN technology set off a new boom in job creation?

The question is a fundamental one for the American economy given that policy makers in Washington often look to the technology sector to pick up the slack in the employment market.

Meanwhile, the fortunes of Silicon Valley start-ups continue to be closely followed, in part because of the spectacular wealth they can generate for their founders, but also because of the assumption that these new companies are a significant source of new employment.

So it will likely disappoint many people that four prominent economists assembled for a recent panel discussion to explore the link between technology and job creation were, in large part, bearish in their outlook.

Some went so far as to suggest that technology increases unemployment and adds to other problems in the US economy, notably the growing wage disparities between an extremely elite group of earners and everyone else.

The discussion, titled "Can Tech Power the Next Jobs Boom?" took place at Wharton's San Francisco campus and was co-sponsored by the Churchill Club, a Silicon Valley business and technology forum.

'Superstar' effect

Several troubling data points emerged, including one offered by Erik Brynjolfsson, a professor at MIT's Sloan School of Management and director of the MIT Center for Digital Business.

Working with fellow MIT professor Andrew McAfee, Brynjolfsson compared the market capitalization and payrolls of four of the biggest tech companies. His conclusion: While the companies had astronomical values on Wall Street, their job production was minimal.

The four - Apple, Amazon, Facebook and Google - at the time had a market cap in the neighborhood of US$1 trillion, which is roughly 6.25 percent of the combined market cap of all US companies. But the four employ about 190,000 people, fewer than the number of jobs the US economy needs to add about every six weeks to just keep pace with population growth.

The implication, said Brynjolfsson, is that even hugely successful tech companies cannot be counted on to create the kinds of jobs the economy needs.

Brynjolfsson also described what he called a "superstar" effect in technology-related wealth distribution, a trend that has become pronounced in the last decade. In recent years, he said, the majority of GDP growth has benefited a very small part of the population, less than 1 percent. In many cases, even college-educated workers are not sharing in the growing pie. "It's becoming a winner-take-all situation," he said.

"Technology doesn't automatically lift the fortunes of all people," Brynjolfsson noted. "It's something of a paradox. Profits have never been higher, innovation is roaring along, GDP is high, but job creation is lagging terribly, and the share of profits going to labor is at a 60-year low. This is one of the most important issues facing our society."

Citing the work of economist Joseph Schumpeter, Brynjolfsson noted that technology has historically provided "creative destruction" for an economy, causing some jobs to disappear while bringing others into existence. "But the last 10 years have been different. Technology simply hasn't been creating jobs as it did before."

It's a double-barreled effect, Brynjolfsson added. Not only are today's technology companies creating fewer jobs, but the products they make, notably computerized automation equipment, often lead to further job losses in other parts of the economy. These second-effect job losses are further encouraged by off-shoring and by the declining power of labor unions.

"Improvements in technology can improve productivity," he said. "For most of the 20th century, those productivity increases were associated with job growth and growing wages. But there is no economic law saying that always has to be the case. It's quite possible to make the pie bigger, but with most people having a smaller slice. That is what has been happening recently."

|

Romantic like 'The Notebook': 91-year-old illustrator's love leaves Chinese netizens in tears

Romantic like 'The Notebook': 91-year-old illustrator's love leaves Chinese netizens in tears

![]()