China's tax policies invigorate private economy

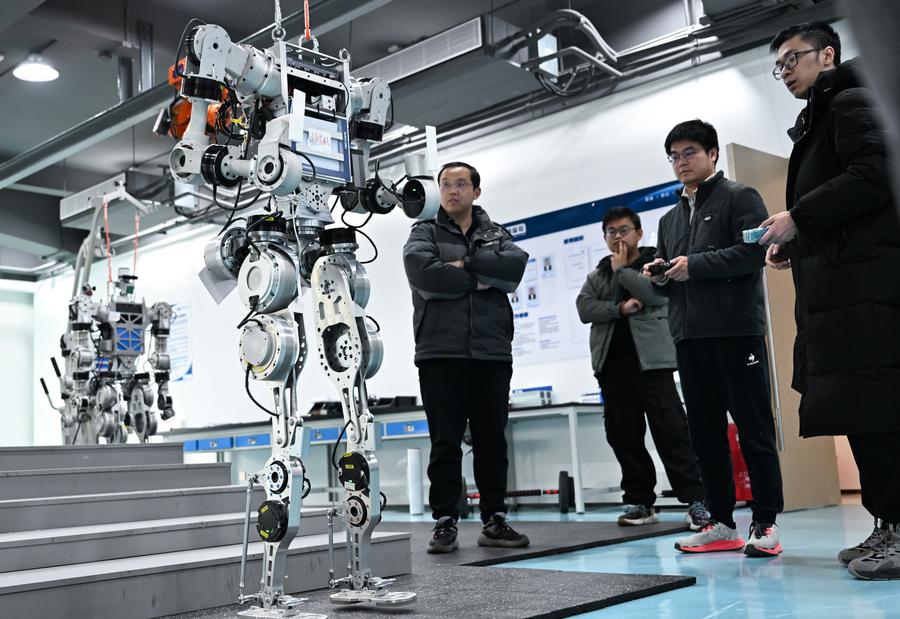

Members of the R&D team of Wuhan Glory Road Intelligent Technology Co., Ltd., debug the humanoid robot at the company in Wuhan, central China's Hubei Province, Feb. 24, 2025. (Xinhua/Du Zixuan)

BEIJING, Feb. 26 (Xinhua) -- China's tax cuts, fee reductions and tax refunds aimed at supporting sci-tech innovation and the manufacturing industry benefited privately-owned market entities and stimulated the country's private sector in 2024, official data showed on Wednesday.

Total tax cuts, fee reductions and tax refunds resulting from these supportive policies amounted to approximately 2.63 trillion yuan (about 366.54 billion U.S. dollars) last year, according to data from the State Taxation Administration.

Taxpayers from the private sector, including private enterprises and individual businesses, enjoyed more than 60 percent, or around 1.59 trillion yuan, of this total.

These favorable policies have injected impetus into the private sector's development. The growth rate in the sales revenue of the private sector outpaced the national average for all enterprises by 0.5 percentage points in 2024, the data revealed.

Within the private sector, sales revenue in the high-tech manufacturing and digital economy industries increased by 13 percent and 4.7 percent year on year, respectively.

Photos

Related Stories

- New round of stimulus steps anticipated

- China remains attractive investment destination: report

- China’s tech hub Shenzhen eyes 5.5% growth in 2025 as economic powerhouses take lead in driving industrial upgrades

- High-tech firms top Hurun’s list of China’s 500 most valuable private companies in 2024

- China to cement legal protection for private sector

Copyright © 2025 People's Daily Online. All Rights Reserved.