China to prioritize small businesses in tax rebates: Premier Li

BEIJING, March 11 (Xinhua) -- China will give priority to small and micro enterprises in its tax rebates to help them navigate difficulties, Premier Li Keqiang said Friday.

Small and micro firms are of a large amount and cover a wide range of sectors, helping create a great number of job opportunities, Li said, stressing many of them are financially strapped.

The country's goal is to refund all value-added tax (VAT) credits to these firms by the end of June, and complete the refund to key sectors, such as manufacturing and R&D-intensive service, within 2022, Li said.

Since the launch of the VAT reform in 2013, China has reduced taxes by 8.7 trillion yuan (about 137.4 billion U.S. dollars), Li said.

Businesses have benefited from the tax refunds and fee cuts, which help create new sources of tax revenue and cultivate market entities, Li added.

Photos

Traditional tie-dye products of Buyi ethnic group in Guizhou popular among tourists

Traditional tie-dye products of Buyi ethnic group in Guizhou popular among tourists Girls from mountainous areas in Hainan pursue football dreams

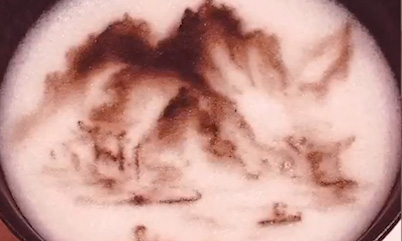

Girls from mountainous areas in Hainan pursue football dreams Chinese artist forms elaborate images using whisked tea foam in revival of Song Dynasty’s cultural splendor

Chinese artist forms elaborate images using whisked tea foam in revival of Song Dynasty’s cultural splendor Wild lilies in full bloom as snow melts in Xinjiang

Wild lilies in full bloom as snow melts in Xinjiang

Related Stories

- Chinese premier stresses gathering wisdom to improve gov't work

- Li stresses strengthening key supplies

- China to practice list-based management for all items requiring administrative approval, implement category-based management of corporate credit risks

- China welcomes companies from worldwide to further expand investment: Premier

- Chinese premier urges enhanced pragmatic cooperation with Russia

Copyright © 2022 People's Daily Online. All Rights Reserved.