A bank in China has begun using satellite remote sensing technology to grant loans to farmers, as part of the efforts to control cost and shorten the application process.

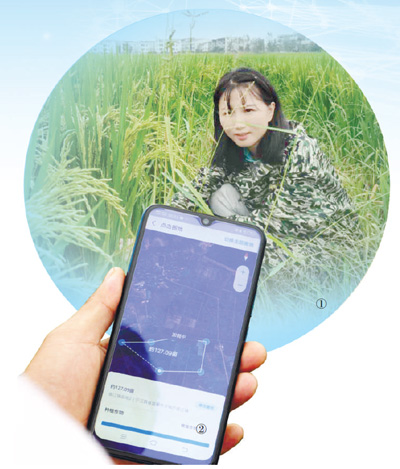

A farmer applies for a loan on his phone.

In September of this year, MYbank, China's first digital bank, began to promote loans using satellite remote sensing technology across the country. As of today, the product has covered one third of the counties in the country, with a total credit line of more than 80 billion yuan (11.92 billion U.S. dollars).

What exactly are loans related to satellite remote sensing technology? "To put it simply, the biggest feature of loans using satellite remote sensing technology is to incorporate the analysis results of artificial intelligence algorithms on satellite remote sensing images of farmland into the credit model built by banks, so as to more accurately identify the credit situation of farmers." Zou Jianbing, an expert on rural financial business at MYbank, said.

"At the beginning of the test, the team thought about using drones to shoot farmland and developing apps to allow farmers to photograph farmland, but after the test we found that the cost was relatively high and it would be difficult to popularize across the country. Thus we decided to introduce satellite remote sensing technology," Wang Jian, chief algorithm expert for rural finance at MYbank, shared.

Wang added that based on cloud computing, artificial intelligence and other technical capabilities, the current crop identification accuracy for satellite remote sensing technology of MYbank is more than 93 percent.

"By analyzing the images of farmland captured by satellite remote sensing, we can identify not only the size of farmland, but also the type, growth and yield of crops. According to this key information, combined with the comprehensive judgment of farmers' credit history, we can reasonably grant credit to farmers," Wang Jian added.

More than 50,000 farmers, including Liu Yingfeng, have received loans.

"I didn't submit any paperwork at the time of application; I didn't make a real estate mortgage, and I didn't see the account manager. The procedure is very simple, and the loan is very fast," said Liu Yingfeng, on his application for loans.

"If you want to win the trust of farmers, you must have excellent products and services in place," Zou Jianbing said, adding the loan related to satellite remote sensing technology can indeed solve the financial problems of farmers to a certain extent, especially in shortening the application process.

The bank has also been effective in cost control. Data shows that compared with the cost of a loan issued by a traditional bank, which often costs hundreds of yuan, to receive a loan using the satellite remote sensing technology only costs 2.3 yuan (about $0.34).

"Only by providing long-term financial services for farmers and controlling costs can we have sufficient motivation." Zou Jianbing said.

Fire brigade in Shanghai holds group wedding

Fire brigade in Shanghai holds group wedding Tourists enjoy ice sculptures in Datan Town, north China

Tourists enjoy ice sculptures in Datan Town, north China Sunset scenery of Dayan Pagoda in Xi'an

Sunset scenery of Dayan Pagoda in Xi'an Tourists have fun at scenic spot in Nanlong Town, NW China

Tourists have fun at scenic spot in Nanlong Town, NW China Harbin attracts tourists by making best use of ice in winter

Harbin attracts tourists by making best use of ice in winter In pics: FIS Alpine Ski Women's World Cup Slalom

In pics: FIS Alpine Ski Women's World Cup Slalom Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa

Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa China's FAST telescope will be available to foreign scientists in April

China's FAST telescope will be available to foreign scientists in April "She power" plays indispensable role in poverty alleviation

"She power" plays indispensable role in poverty alleviation Top 10 world news events of People's Daily in 2020

Top 10 world news events of People's Daily in 2020 Top 10 China news events of People's Daily in 2020

Top 10 China news events of People's Daily in 2020 Top 10 media buzzwords of 2020

Top 10 media buzzwords of 2020 Year-ender:10 major tourism stories of 2020

Year-ender:10 major tourism stories of 2020 No interference in Venezuelan issues

No interference in Venezuelan issues

Biz prepares for trade spat

Biz prepares for trade spat

Broadcasting Continent

Broadcasting Continent Australia wins Chinese CEOs as US loses

Australia wins Chinese CEOs as US loses