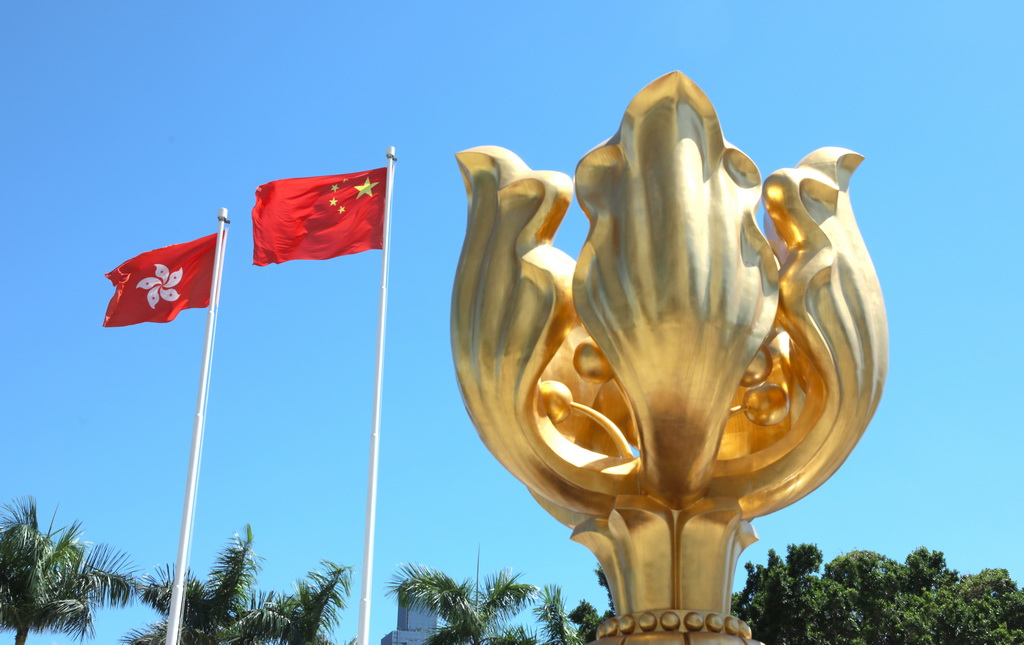

U.S. politicians who play the political game of “imposing sanctions” to assert dominance likely feel greatly disappointed, as their threat to revoke the preferential trade treatment for China’s Hong Kong Special Administrative Region (HKSAR) and impose sanctions against the region would backfire on U.S. companies in Hong Kong.

“We will take action to revoke Hong Kong’s preferential treatment as a separate customs and travel territory from the rest of China,” U.S. President Donald Trump told a press conference on May 30, following a vote of China’s top legislature on its draft decision on establishing and improving the legal system and enforcement mechanisms for Hong Kong to safeguard national security.

The U.S. would also impose sanctions on Chinese and Hong Kong officials “directly or indirectly involved in eroding Hong Kong’s autonomy,” Trump said.

However, the threatened sanctions will not change China’s resolve to safeguard national security in Hong Kong, and will instead become a double-edged sword that endangers American companies operating in Hong Kong.

Revoking Hong Kong’s preferential treatment as a separate customs would indeed have an impact on Hong Kong’s trade and economy, but the U.S itself would not go unscathed.

As the annual value of Hong Kong exports to the U.S. is only around $500 million, which accounts less than 0.1 percent of the region’s total annual value of exports, it is clear Hong Kong doesn’t mainly rely on the U.S. for foreign trade.

In contrast, Hong Kong has been the greatest economy for the U.S. to earn a trade surplus in goods.

The U.S. makes $30 billion in Hong Kong annually. With roughly 85,000 American citizens living in Hong Kong, over 1,300 American companies, including almost all the major financial companies of the U.S., operate in Hong Kong. The region has offered these U.S. companies the same preferential policies as that enjoyed by local companies on accessing the Chinese mainland market under the CEPA (the Mainland and Hong Kong Closer Economic Partnership Arrangement).

If the U.S. were to impose sanctions against Hong Kong, it had better ask how these U.S. companies feel about the move.

Hong Kong is the third largest export market of alcoholic beverages for the U.S., the fourth largest export market of the country’s beef, and the seventh largest export destination of American agricultural products.

If the U.S. were to unilaterally change trade policies for Hong Kong, exports of U.S. companies would be the first to suffer the consequence.

As the world’s harbor of freedom, Hong Kong will not see its development trend determined by the U.S.

Experts have pointed out, as long as the position of the Asian-Pacific region in the world and the region’s importance in global economic development continues to rise, and as long as China still plays important roles in the world, any sanctions from the U.S. would only have a temporary influence on Hong Kong.

Recently, Chinese Internet technology company NetEase and e-commerce giant JD.com have been approved to launch a secondary listing in Hong Kong, while news on a secondary listing of China’s leading search engine operator Baidu and largest online travel agency Ctrip in Hong Kong is also spreading.

Talents and capitals around the world are still racing to ride on the crest of success in Hong Kong. A move by the U.S. to abandon the region would mean that it will soon be replaced by capitals, enterprises, and talents of the Chinese mainland and other countries in the world.

The biggest risk that causes foreign people and companies to leave Hong Kong is not from the national security laws in Hong Kong, but the violence and social unrest in the city, said a foreign entrepreneur who has lived in Hong Kong for many years.

The national security laws to be introduced in Hong Kong will never influence Hong Kong’s role as a major international financial center, but will only create a more stable and predictable environment for the operation and development of enterprises of various countries in Hong Kong.

Fire brigade in Shanghai holds group wedding

Fire brigade in Shanghai holds group wedding Tourists enjoy ice sculptures in Datan Town, north China

Tourists enjoy ice sculptures in Datan Town, north China Sunset scenery of Dayan Pagoda in Xi'an

Sunset scenery of Dayan Pagoda in Xi'an Tourists have fun at scenic spot in Nanlong Town, NW China

Tourists have fun at scenic spot in Nanlong Town, NW China Harbin attracts tourists by making best use of ice in winter

Harbin attracts tourists by making best use of ice in winter In pics: FIS Alpine Ski Women's World Cup Slalom

In pics: FIS Alpine Ski Women's World Cup Slalom Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa

Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa China's FAST telescope will be available to foreign scientists in April

China's FAST telescope will be available to foreign scientists in April "She power" plays indispensable role in poverty alleviation

"She power" plays indispensable role in poverty alleviation Top 10 world news events of People's Daily in 2020

Top 10 world news events of People's Daily in 2020 Top 10 China news events of People's Daily in 2020

Top 10 China news events of People's Daily in 2020 Top 10 media buzzwords of 2020

Top 10 media buzzwords of 2020 Year-ender:10 major tourism stories of 2020

Year-ender:10 major tourism stories of 2020 No interference in Venezuelan issues

No interference in Venezuelan issues

Biz prepares for trade spat

Biz prepares for trade spat

Broadcasting Continent

Broadcasting Continent Australia wins Chinese CEOs as US loses

Australia wins Chinese CEOs as US loses