|

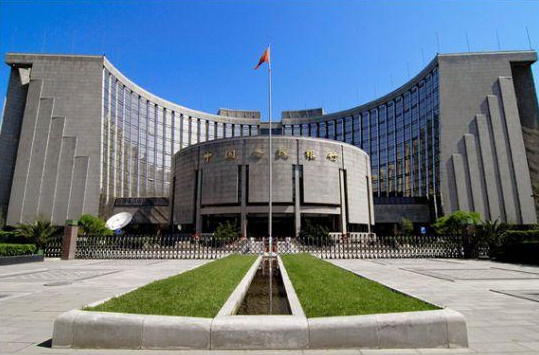

BEIJING, Aug. 11 -- China's central bank will improve its central parity system to better reflect market development in the exchange rate of the Chinese currency renminbi against the U.S. dollar.

Effective on Tuesday, daily central parity quotes reported to the China Foreign Exchange Trade System before the market opens should be based on the closing rate of the inter-bank foreign exchange rate market on the previous day, supply and demand in the market, and price movement of major currencies, the People's Bank of China (PBOC) said.

The PBOC said the RMB's central parity has deviated from its actual market rate by "a large extent and for a long duration," which has "undermined the authority and the benchmark status" of the central parity system.

As the economy of the United States improves, with interest rate hikes highly expected within this year, currencies of emerging economies have generally depreciated against their currency and a strong RMB has created pressure on China's exports, the PBOC said in a separate statement on Tuesday.

Following the change, the central parity rate of the RMB, or the yuan, weakened sharply by 1,136 basis points, or nearly 2 percent, to 6.2298 against the U.S. dollar on Tuesday.

Shocking scenes found in 4000-year-old earthquake relic

Shocking scenes found in 4000-year-old earthquake relic Female soldiers add color to military parades

Female soldiers add color to military parades Taiwan campus belle with gorgeous look

Taiwan campus belle with gorgeous look  Stunning photos of China’s fighters and airborne troops

Stunning photos of China’s fighters and airborne troops Mums stage breastfeeding flash mob

Mums stage breastfeeding flash mob PLA South China Sea Fleet conducts live fire exercise

PLA South China Sea Fleet conducts live fire exercise Beauty of Tsinghua University transforms into car model

Beauty of Tsinghua University transforms into car model Official shot having sex with two college girls

Official shot having sex with two college girls Moscow “spider-man” climbs Chinese skyscraper

Moscow “spider-man” climbs Chinese skyscraper Fiery freezer

Fiery freezer Bearly getting along

Bearly getting along Top luxury firms struggling in China

Top luxury firms struggling in China Japan reads too much into WWII parade

Japan reads too much into WWII paradeDay|Week