BEIJING, July 16 -- The recent volatility in China's equity markets does not pose a systemic risk to the nation's real economy or financial system, with Chinese banks having relatively little direct exposure to stocks, global rating agency Fitch said on Thursday.

The latest official figure showing China's economic growth rose 7 percent year on year in the second quarter supports Fitch's view that the real economic impact of equity market volatility will be minimal, Fitch said in a report.

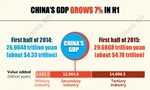

China's economy posted better-than-expected growth of 7 percent in the April-June period, unchanged from the first quarter, the National Bureau of Statistics (NBS) announced on Wednesday.

"Fitch does not expect the equity market correction to have a major impact on Chinese banks' balance sheets or pose a systemic risk to the banking sector. Banks are not allowed to lend directly to customers for margin lending," it said.

Moreover, equity allocation represents only a small portion of their investment portfolios, with direct investment in equities making up less than 1 percent of bank assets at the end of 2014, noted the report.

China's stock market has showed early signs of recovery due to a slew of rescue measures. The benchmark Shanghai Composite Index (SCI) lost more than 30 percent in less than a month from its peak on June 12, as margin traders began to unwind their positions and some investors cashed out.

However, the rapid evolution of the market and related volatility has highlighted several challenges for brokers, with risk management and governance challenges highlighted by an aggressive increase in margin lending alongside a rapid rise in equity valuations earlier in the year, it cautioned.

The Chinese stock market was among the world's best performers earlier this year, with the SCI surging more than 150 percent in 12 months, partly fueled by margin trading, as some investors borrowed money to buy shares.

Yunnan-Myanmar Road: The past and present

Yunnan-Myanmar Road: The past and present Campus belle of Xiamen University gets popular online

Campus belle of Xiamen University gets popular online Who says moms cannot be trendy and hot?

Who says moms cannot be trendy and hot? 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces Stunning photos of China's fighter planes

Stunning photos of China's fighter planes Enteromorpha hits Qingdao coast

Enteromorpha hits Qingdao coast Eight fruits that defend men's health

Eight fruits that defend men's health  First batch of female combat pilots with duel degrees fly Flying Leopard

First batch of female combat pilots with duel degrees fly Flying Leopard Top 10 secrets of longevity

Top 10 secrets of longevity China’s GDP grows 7% in H1

China’s GDP grows 7% in H1 Iran nuclear deal defuses Mideast tension

Iran nuclear deal defuses Mideast tension New PLA campaign targets new recruits: Military academy

New PLA campaign targets new recruits: Military academy Classical Tang Dynasty garden unearthed at Chengdu construction site

Classical Tang Dynasty garden unearthed at Chengdu construction siteDay|Week