|

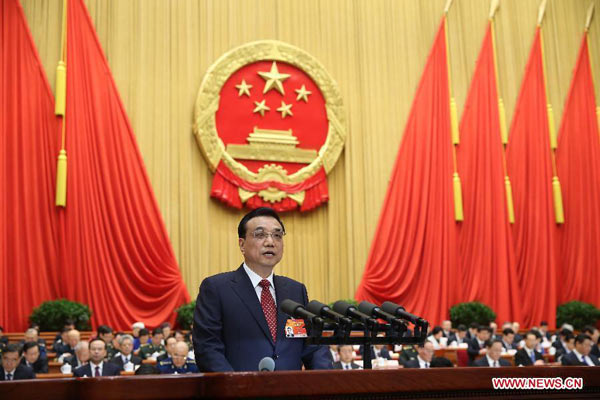

| Chinese Premier Li Keqiang delivers the government work report during the opening meeting of the third session of China's 12th National People's Congress (NPC) at the Great Hall of the People in Beijing, capital of China, March 5, 2015. (Xinhua/Pang Xinglei) |

Editor’s Note

In his government work report to the annual session of the National People’s Congress (NPC) which opened Thursday, Premier Li Keqiang pledged fresh breakthroughs in major reforms, saying he would work to generate new momentum for development. The premier also vowed to improve China’s economic structure while stabilizing growth. The following summarizes highlights from the work report, and offers analysis of key reforms on the agenda.

On reforming investment

China will considerably reduce the number of government approvals required for investment projects, and some project approvals will be conducted online, according to the government work report.

China will also seek to ease market access for private investment and encourage the establishment of equity investment funds with private capital, it said.

“Encouraging the use of private capital to set up equity funds will facilitate financing for small firms and start-ups, which will serve as new sources of economic dynamism for China,” Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, told the Global Times on Thursday.

The government will also seek to encourage a Public-Private-Partnership (PPP) model for investment in the infrastructure and utilities sectors, the report said.

“The PPP model and equity funds will provide new capital sources for major investment projects,” Xu Hongcai, director of the Department of Information under the China Center for International Economic Exchanges, told the Global Times on Thursday.

However, Xu noted that the government should come up with measures to provide sufficient investment return for private capital to motivate them to participate in major investment projects.

On capital market reforms

China will strengthen its capital system and implement a registration-based IPO system, the report said.

Regional equity markets to serve small and medium-sized enterprises will be developed and credit asset securitization will be advanced, it said.

According to the report, China will also seek to expand corporate bond issuances and develop its financial derivatives markets.

“These measures could help to direct funds toward supporting the real economy. A registration-based IPO system, which is expected to greatly lower the threshold for IPOs, will be a major task for mainland capital markets this year,” Dong said.

On SOE reform

To deepen reforms of State-owned enterprises (SOEs) and State-owned assets, China will accurately define the functions of SOEs and push ahead with the reforms on a category-by-category basis, the report outlined.

The government will seek to speed trials on establishing investment companies and operating companies backed by State capital to create market-based operation platforms and improve the operating efficiency of State capital, the report said.

Mixed-ownership reforms will be conducted, and investment by non-State capital in SOE projects will be encouraged and regulated, it said.

According to the report, reforms in electricity, oil and gas will be accelerated.

“The focus for now seems to be on developing mixed-ownership structures, improving management incentive schemes, and accelerating reforms in the power, oil and gas sectors, UBS Securities economists led by Wang Tao said in a research note e-mailed to the Global Times on Thursday.

“We maintain that local-level SOE reforms may proceed faster given that local governments will be facing increased pressure to divest assets and service their debt this year,” the UBS research note said.

China hosts overseas disaster relief exercise for the first time

China hosts overseas disaster relief exercise for the first time 20 pairs of twins who will become flight attendants in Sichuan

20 pairs of twins who will become flight attendants in Sichuan J-11 fighters in air exercise

J-11 fighters in air exercise PLA soldiers operating vehicle-mounted guns in drill

PLA soldiers operating vehicle-mounted guns in drill Beauties dancing on the rings

Beauties dancing on the rings Blind carpenter in E China's Jiangxi

Blind carpenter in E China's Jiangxi Top 10 highest-paid sports teams in the world

Top 10 highest-paid sports teams in the world In photos: China's WZ-10 armed helicopters

In photos: China's WZ-10 armed helicopters UFO spotted in several places in China

UFO spotted in several places in China Obama is sowing discontent in S.China Sea

Obama is sowing discontent in S.China Sea Rescuers work through night to reach cruise ship survivors

Rescuers work through night to reach cruise ship survivors Driving through limbo

Driving through limbo Facing down MERS

Facing down MERSDay|Week