BEIJING, July 8 -- China's Ministry of Finance will not sell shares of listed companies amid "abnormal volatility" of the stock market, it pledged on Wednesday.

It also asked state-owned financial companies administered by the central government not to sell shares in listed firms in which they have controlling stakes, the ministry said in a statement.

The ministry supports these financial companies in buying more shares when stock prices slide below their reasonable value, according to the statement.

The ministry will further support the development of state-owned financial companies so that they can provide enhanced services for the real economy and strengthen earnings, the statement said.

The latest supportive measure joined a slew of others announced earlier Wednesday aimed at stemming massive stock market sell-offs.

The State-owned Assets Supervision and Administration Commission has encouraged state-owned companies to purchase more shares to stabilize prices and China Securities Finance Corporation Limited (CSF), the national margin trading service provider, also pledged on Wednesday to purchase more shares of small- and medium-sized listed companies to ease stock market liquidity.

The central bank said it will support the CSF to ease liquidity through channels such as interbank lending, floating financial bonds and mortgage financing.

Despite these moves, Chinese stocks tumbled with the benchmark Shanghai Composite Index down 5.9 percent to finish at 3,507.19 points at closing on Wednesday.

Campus belle in HK goes viral online

Campus belle in HK goes viral online Lugou Bridge in 78 years: July 7 incident

Lugou Bridge in 78 years: July 7 incident Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

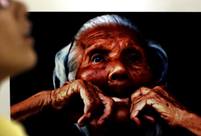

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Top 10 most competitive Chinese cities in Belt and Road Initiative

Top 10 most competitive Chinese cities in Belt and Road Initiative Top 10 travel destinations in the world

Top 10 travel destinations in the world Xi talks peace at war memorial

Xi talks peace at war memorial Vietnam-US bond less rosy than it appears

Vietnam-US bond less rosy than it appears Furry funeral

Furry funeral Infrastructure investment boosted to stabilize growth

Infrastructure investment boosted to stabilize growth Day|Week