BEIJING, June 12 -- China's first batch of certificates of deposit (CDs) will hit the market next week, bringing the country a step closer to market-set interest rates.

Nine banks, including the "big four" state-owned lenders, will start issuing the country's first batch of large-scale CDs on June 15, according to a Thursday announcement by the China Foreign Exchange Trading System.

Much of the first batch will have terms of one year or less. The subscription threshold for individual investors is 300,000 yuan (about 49,020 U.S. dollars) while that for institutions is 10 million yuan.

The announcement came one week after the People's Bank of China released regulations allowing the nation's banks to issue the CDs to individual and institutional investors. Previously, China only allowed the CDs to be issued and traded among banks.

Under the regulations, the interest on the CDs can be either fixed or floating.

For those with floating rates, the Shanghai Interbank Offered Rate (Shibor) will be used as a benchmark.

This would allow domestic banks to bypass interest rate controls. China has removed its grip on lending rates, but the ceiling on deposit rates is still retained at 1.5 times the benchmark.

The Shibor, which is based on the cost of interbank lending, stood at 3.184 percent for six-month loans and 3.4 percent for one-year lending on Friday. The current interest rates for six-month and one-year ordinary deposits cannot exceed 3.075 percent and 3.375 percent, respectively.

Lu Xiaodong, a professor at Sun Yat-Sen University, considered the CDs as a thermometer that the central bank offered to individual and institution investors, monitoring the status of capital flow and market supply.

"Serving as a new financial tool, the CDs will push China's market-oriented reforms of interest rates through the last mile," Lu said.

Freer interest rates will give private businesses easier access to credit, aiding the economy's transformation toward more service and consumer driven growth as traditional engines such as exports and state-led investment lose steam.

As a key component of China's broader economic and financial reforms, interest rate liberalization is high on policy makers' to-do list this year.

At a press conference on the sidelines of the annual national legislature session in March, the central bank governor Zhou Xiaochuan said the possibility for China to fully liberalize its interest rate mechanism is "very high" this year.

On May 1, a long-awaited deposit insurance scheme was put in place, which was considered a precondition for China to free up deposit rates.

Two weeks later, the central bank cut the benchmark lending and deposit interest rates and at the same time lifted the upper limit of the floating range for deposit interest rates from 1.3 to 1.5 times of the benchmark level. It had already raised the cap in March from 1.2 to 1.3 times.

China Merchants Securities analyst Xie Yaxuan forecast more benchmark interest rate reductions in the second half of the year and the ultimate elimination of the deposit rate ceiling.

In addition to relaxing interest rate controls, a broader liberalization of China's economic policies, which aimed to give the markets a "decisive" role in resources allocation, included to realize a full convertibility of the yuan and open the capital account to permit more foreign investment.

Abandoned village swallowed by nature

Abandoned village swallowed by nature Graduation: the time to show beauty in strength

Graduation: the time to show beauty in strength School life of students in a military college

School life of students in a military college Top 16 Chinese cities with the best air quality in 2014

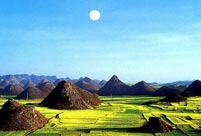

Top 16 Chinese cities with the best air quality in 2014 Mysterious “sky road” in Mount Dawagengzha

Mysterious “sky road” in Mount Dawagengzha Students with Weifang Medical University take graduation photos

Students with Weifang Medical University take graduation photos PLA soldiers conduct 10-kilometer long range raid

PLA soldiers conduct 10-kilometer long range raid Stars who aced national exams

Stars who aced national exams

PLA helicopters travel 2,000 kilometers in maneuver drill

PLA helicopters travel 2,000 kilometers in maneuver drill Investment slows to 15-year low

Investment slows to 15-year low China, Myanmar focus on win-win ties

China, Myanmar focus on win-win ties Dangerous stigma

Dangerous stigma Smashing drug addiction

Smashing drug addictionDay|Week