|

Vice Finance Minister Zhu Guangyao hit back over the weekend at IMF warnings that the Chinese economy may face the threat of a hard landing.

"In general, we think they [the IMF] are a very professional financial institution, but [due to] some of the methodology used and some traditional thinking, they also need reform," Reuters quoted Zhu as saying Saturday to a group of foreign journalists in Washington DC on the sidelines of the annual spring meetings of the IMF and World Bank.

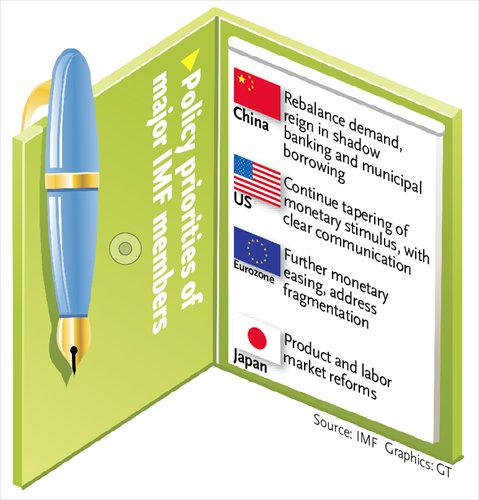

Christine Lagarde, managing director of the IMF, used the term "hard landing" when she warned of the risk facing China's economy in the IMF's Global Policy Agenda, which was released in Washington DC on Thursday.

The risk was small according to the IMF report, but it urged China to be alert to risks in its shadow banking system.

The Chinese government is taking action to cope with financial risk, Zhu said.

"While local government debt is manageable, the Chinese authorities will continue to ensure that local government financing will be tightly regulated, transparent and sustainable," Yi Gang, deputy governor of the People's Bank of China (PBC), the country's central bank, said in his statement delivered Saturday at the International Monetary and Financial Committee meeting during the annual spring meetings.

The Chinese government will maintain the stability and continuity of macroeconomic policies to achieve stable growth, while continuing efforts to rebalance the economy and deepen reforms, read Yi's statement posted on the IMF's website.

"The hard landing warning is undoubtedly exaggerated, as the fundamentals of the economy remain strong enough to ensure that the overall growth will be kept within healthy limits," Xu Hongcai, director of the Department of Information under the China Center for International Economic Exchanges (CCIEE), a Beijing-based think tank, told the Global Times on Sunday.

The central government has rolled out a raft of pro-growth measures that include investment in railroads and renovation of run-down areas, which Xu said would protect against a sudden downturn.

There are concerns about banks' troubled assets, as the asset quality of some enterprises could further deteriorate amid the economic slowdown and sluggish demand. However, there is little chance of a surge in risk, Zhang Lei, a Beijing-based macroeconomic analyst with Minsheng Securities, told the Global Times on Sunday.

The Chinese government still has enough resources to deal with financial risk, Zhang noted.

Multi-faceted capital market solutions such as asset securitization will help ease concerns over banks' off-balance sheet accumulated leverage, he said, noting that China's banks generally grant secured loans based on collateral rather than unsecured ones simply based on applicants' credit.

Instead of being a drag on the near-term economic growth, the new leadership's reform blueprint will help safeguard the economy against any hard landing, analysts said.

China's growth potential will be enhanced with deepened reforms in an all-round manner, stressed Xu of CCIEE.

The government has already released a number of reform measures and more reforms are in the pipeline, economists at UBS Securities said in a research note sent to the Global Times on Friday, toning down fears that the country may decelerate its pace of reform because of growth concerns.

The near-term reforms will serve to guard the bottom line of China's growth target, the economists said.

In his statement, the PBC's Yi also reiterated the commitment to financial reforms.

In addition to a continuation of the yuan's foreign exchange rate reform, "the market-based interest rate reform will also proceed, with deposit rates being liberalized in the medium term. And a deposit insurance scheme will be set up in due course," Yi said, pointing to a more gradual approach to pushing forward with interest rate reforms.

Wonderful moment of China's airborne forces

Wonderful moment of China's airborne forces Bai Baihe shoots for fashion magazine

Bai Baihe shoots for fashion magazine Red terraced fields in Dongchuan of Yunnan

Red terraced fields in Dongchuan of Yunnan Jiaju Tibetan Village

Jiaju Tibetan Village Spring dating

Spring dating Confucius institute at UC Davis

Confucius institute at UC Davis Little painted faces at temple fair

Little painted faces at temple fair Top 10 safest airlines in the world

Top 10 safest airlines in the world Foreign students at China-Myanmar border

Foreign students at China-Myanmar border The backstage of the Fashion Week

The backstage of the Fashion Week College students in Han costumes

College students in Han costumes Postgraduate works as waitress

Postgraduate works as waitress Life in a Lahu village in Yunnan

Life in a Lahu village in Yunnan An orphan’s wedding

An orphan’s wedding Hollywood documentary brings Diaoyu Islands truth to new audience

Hollywood documentary brings Diaoyu Islands truth to new audienceDay|Week|Month